Investment gold and investment silver are among the safest forms of investing in precious metals, which have maintained their value for centuries. In our offer, you will find a wide selection: gold coins, silver coins, gold bars, and silver bars from renowned manufacturers.

In today's economically unstable times, investing in gold and silver represents an ideal way to preserve and grow your financial assets. These precious metals are valued for their ability to resist inflation and economic turbulence, making them an attractive option for both experienced and novice investors.

Why Invest in Gold and Silver?

Investment gold, in the form of coins or bars, offers high liquidity, meaning you can easily sell it anywhere in the world. Gold prices are stable and often rise during periods of economic uncertainty. Silver coins and bars are an excellent choice for those looking to diversify their portfolio, as investment silver is more affordable to a broader range of investors. Both metals are proven methods of protecting wealth from inflation and economic uncertainty.

Protection Against Inflation: The value of gold and silver holds steady over time and often rises during periods of economic instability.

Global Liquidity: Investment gold and silver are globally recognized and easily converted to cash anywhere in the world.

Portfolio Diversification: Adding gold and silver to your investment portfolio reduces overall risk and increases the stability of your investments.

Physical Ownership: Unlike stocks or bonds, you physically hold precious metals in the form of coins or bars.

The Benefits of Investing in Gold and Silver

Investment gold and silver offer a unique opportunity for long-term wealth preservation, independent of fluctuations in the financial markets.

Gold

Gold has been regarded as a safe haven for investors during periods of economic uncertainty for centuries. The price of gold often reflects global economic stability.

Store of Value: Gold prices maintain purchasing power over time and are resistant to economic crises.

High Liquidity: Globally accepted, investment gold can be easily converted into cash anywhere in the world.

Portfolio Diversification: Investing in gold helps spread risk and protect wealth from volatile markets.

Limited Supply: Gold is a rare metal with limited supply, which can contribute to its long-term value growth.

Silver

Investment silver offers an excellent balance between price and return, making it an attractive choice for investors seeking a more affordable alternative to gold.

High Growth Potential: The price of silver is often volatile, offering opportunities for higher returns.

Broad Industrial Use: Silver is widely used in technology, medicine, and energy, influencing its demand and price.

Accessibility for All: The lower price of silver allows for investment even with smaller capital.

Tax Advantages of Investing in Gold

When purchasing investment gold, you benefit from a VAT exemption, further enhancing the appeal of this investment. Additionally, gold and silver coins are popular among collectors who appreciate their cultural significance. In our selection, you will find a wide variety of coins from different countries and periods that can enrich your investment portfolio.

Physical Ownership and Global Recognition

Investing in gold and silver is ideal for those who prefer physical ownership of precious metals over abstract financial instruments. Investment gold and silver are globally recognized and accepted, meaning their value can easily be leveraged anywhere in the world.

Our Offer of Investment Gold and Silver

Our gold and silver coins and bars come with a guarantee of authenticity and the highest quality. For investors looking for special investment opportunities, we also offer limited and rare gold coins with high collectible value.

Why Buy Gold and Silver from Us?

Our company offers products from world-leading mints and manufacturers, ensuring authenticity and quality. Our experts provide detailed insights into the latest trends in the precious metals market and help you create an optimal investment strategy. Whether you are an experienced investor or new to precious metals, our services are tailored to meet your individual needs.

Years of Experience: We are leaders in the investment gold and silver market with more than 14 years of tradition.

Guaranteed Quality: All our products come with a guarantee of authenticity and meet the highest quality standards.

Personalized Service: We provide each client with personalized care and tailored services.

Transparency and Trust: We believe in open communication and building long-term relationships with our clients.

Investment Coins vs. Investment Bars

Investment coins and bars are the two primary forms of investing in precious metals. While both represent physical ownership of the metal, there are several key differences between them:

Investment Coins

- Legal Tender: Coins are issued by national mints and have an official face value. Their price is based on the metal content.

- Design and Aesthetics: Often featuring artistic motifs, national symbols, or historical figures, which can add collectible value.

- Liquidity: Thanks to wide recognition, coins are easily traded on the global market.

- Smaller Denominations: Available in various weights, offering flexible investment options.

- Ideal for Collectors: A combination of metal value and collectible interest makes coins attractive.

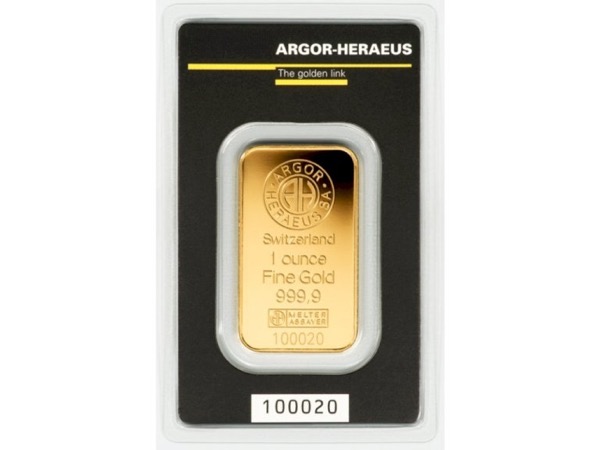

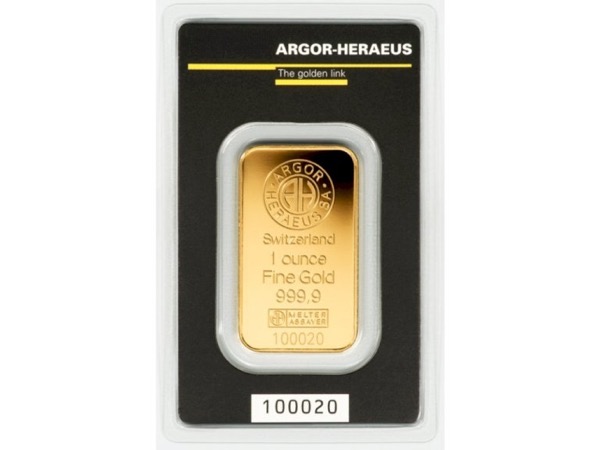

Investment Bars

- Manufacturers: Bars are produced by private refineries or mints without legal tender status.

- Simple Design: Featuring a straightforward design with the manufacturer’s logo and details on weight and purity.

- Lower Premiums: Lower markups over the price of gold, making them advantageous for larger investments.

- Larger Weights: Available in larger weights, suitable for investors seeking higher exposure.

- Cost Efficiency: Ideal for those focusing on minimizing the cost per ounce of metal.

The choice between coins and bars depends on your investment goals, budget, and preferences regarding liquidity and collectible value.

Investing in Gold and Silver

Historical Significance of Precious Metals

Gold and silver have been symbols of wealth and power for millennia. They served as the foundation of currency and trade in many civilizations. Their lasting value and universal acceptance make them a safe haven in times of economic turmoil.

Factors Influencing Prices

Economic Indicators: Inflation, interest rates, and geopolitical events can significantly affect the price of gold and silver.

Supply and Demand: Precious metal mining is limited, while demand continues to grow, affecting gold prices.

Currency: A weakening U.S. dollar often leads to an increase in gold and silver prices.

Investment Strategies

Long-Term Holding: Ideal for those seeking to protect their savings from inflation and economic crises.

Short-Term Trading: Taking advantage of market fluctuations for quick gains.

Portfolio Diversification: Spreading investments across different forms of gold and silver to minimize risk.

Frequently Asked Questions About Investing in Gold and Silver

How do I know the gold and silver I’m buying is genuine? We work with renowned refineries and mints to guarantee the highest quality. We stand behind the authenticity of every product we sell.

Is now a good time to invest in gold and silver? Yes, precious metals are always considered a safe investment, especially during times of economic uncertainty. Current gold prices offer attractive opportunities for investors.

How can I sell my gold or silver? We offer a buyback option at current market prices, ensuring the liquidity of your investments.

Contact Us

Don’t hesitate to contact us for more information or consultation. Our team of experts is ready to assist you every step of the way on your investment journey. Invest with confidence and security through our comprehensive investment gold and silver services. With us, you’ll receive not only quality products but also a partner who helps you achieve your financial goals.