Gold Price & Gold Chart

Current Gold Price

The price of gold is a key indicator for investors interested in precious metals. This price changes daily based on global economic factors, market demand, and supply.

GOLD price

2914.08 EUR/oz

Updated 2025-06-20 11:57:18

Are you interested in selling your gold at a favorable price?

In addition to selling investment gold, we also offer gold buyback at current market prices. If you own gold coins, bars, or jewelry that you'd like to sell, we're happy to offer you a fair price and professional service.

Interest in gold buyback

Why Monitor the Price of Gold?

Gold is considered a safe haven during times of economic uncertainty. Monitoring the price of gold allows you to make informed investment decisions and seize opportunities to buy or sell at optimal times.

Factors Influencing the Price of Gold

Global Economy:

Economic instability increases demand for gold.

Inflation:

Gold is often used as a hedge against inflation.

Dollar Exchange Rate:

A weak dollar can increase the price of gold.

Gold price trend

How to Monitor Current Gold and Silver Prices?

We provide up-to-date information on the gold price in real-time on our website. You can view historical charts, analyze gold price trends, and decide when is the best time to invest.

Benefits of Tracking Prices with Us

Updated Data

Get the latest information on the price of gold.

Analyses and Predictions

Our experts regularly publish analyses of market trends.

Personalized Advice

We'll help you interpret data and recommend suitable investment strategies.

Invest in Gold with Confidence

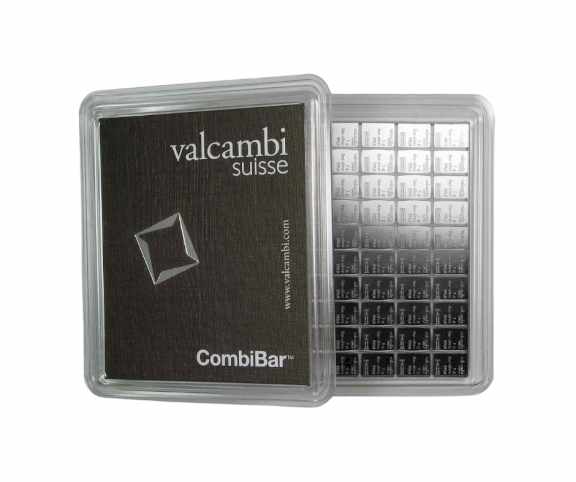

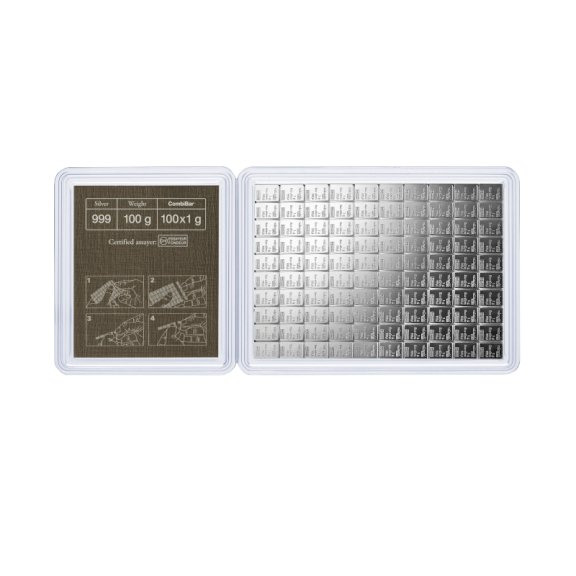

By understanding the price of gold and its development, you can make better investment decisions. Whether you're an experienced investor or a beginner, our services are designed to provide you with all the necessary information. Learn more about investment opportunities on our page Investment Gold

Why Buy from Us?

Historical Development of Gold Prices

Knowing the historical development of gold prices can help you predict future trends. Both gold and silver have gone through various phases of growth and decline, reflecting global economic events.

Long-Term Trends in Gold Prices

2000 - 2010

Significant increase in gold prices due to the financial crisis.

2011 - 2015

Stabilization and slight decrease in prices.

2016 - present

Renewed growth in response to geopolitical uncertainty.

Tips for Investors

How Does Inflation Affect the Price of Gold?

Inflation reduces the purchasing power of currency, often leading investors to precious metals as stores of value. The price of gold tends to rise during periods of high inflation.

Gold as a Hedge Against Inflation

Stable Value

Gold maintains its value even when currency loses value. Learn more on our page Why Invest in Gold.

Safe Haven

Investors turn to gold during economic crises.

Contact Us

Do you have questions about the price of gold or its development? Want to know more about investment opportunities? Contact us, and we'll be happy to help.

ContactsNumismatics BratislavaMACHO & CHLAPOVIČ

Dunajská 48, Bratislava

Numismatics PragueMACHO & CHLAPOVIČ

Slunná 11, Prague