Collector vs. Investor

We often encounter opinions from collectors, especially older ones, that modern-day investors are more of a nuisance on the market — draining quality collectible material and driving up prices. I argue that the continuous price growth existed long before the word “investor” entered our vocabulary. One can observe this even in the underlying asset itself — precious metal.

In the thousands of clients we’ve serviced, I’ve never encountered anyone complaining about this when selling. They simply smile nostalgically, remembering how well they once bought. Even pure investors, who are relatively few on the market, are immensely important. They provide liquidity, reduce spreads, and offer sellers a better chance to liquidate their collections in times of sudden need. And when life, health, or saving a company or mortgaged property is at stake, their presence in the market is priceless.

Numismatics as a Store of Value

The primary reason for price increases is, of course, the expansionary monetary policy of central banks and the undisciplined fiscal policy of governments. It’s true that while the price of gold has risen 140-times over the past 100 years, the value of a coin collection of Habsburgs (ducats and their multiples, thalers and their fractions and multiples) has risen over 1,000-times. The purchasing power of the dollar, pound, Swiss franc, euro, and Czech koruna has decreased dramatically. Some investments are able to withstand this hidden taxation on labor and capital — with the king of hobbies, numismatics, leading the way.

Art struck in precious metal is a classic transmitter of purchasing power across generations and a safe haven. Unlike, say, visual arts, it also has intrinsic value — the value of the metal. And yes, this is something not only top-tier private bankers and portfolio managers have noticed, but also well-educated and capable collectors.

Lot 54 – Ducat 1536, Ferdinand I, Prague

Collecting Principles vs. Investment Strategy

Because Mr. Kokolus is well-versed in quantitative sciences, it’s characteristic that the investment aspect and argumentation through quantitative statistics are always present in his approach.

1) A collector gathers systematically and doesn’t optimize returns.

We do the exact opposite in our qualified investor funds — we cherry-pick high-potential items, diversify broadly to avoid temporary vulnerability in any one coin or medal category. If an item meets price expectations or we receive an irresistible offer, we sell cold-bloodedly. Until his first auction, Mr. Kokolus was like a museum — he didn’t sell. Not even duplicates, triplicates, or lower-quality pieces accumulated over years of collecting.

2) A collector buys rare coins even in lower grades, despite lower investment potential.

This is something a typical investor avoids. The goal is to maximize return, reduce risk, and play it safe. Investors buy rare coins in top condition with documented provenance. These always find buyers — it’s just a matter of price.

3) A collector often overpays when completing a missing piece in their collection.

The justification is: “On average, I bought well, and it will all increase in value anyway.” Investors may also get emotional and overpay occasionally if they’ve been unable to make reasonable purchases for a while. But generally, they are systematic and unaffected when they miss a piece. They don’t need to own it at all costs. They don’t build logical collections — the primary motivator is the potential for appreciation.

4) A pure collector doesn’t sell.

This is the most common argument we hear: “I won’t sell anything — I’m a collector.” or “Why would I sell if it’ll be more expensive next year?”

But let’s be honest — the ideal situation is when the collecting passion continues within the family for more than one generation. However, when there’s no interest to carry on — who knows best where, when, and under what terms to sell? Ideally, this is done while you’re still mentally healthy, well-connected, and informed.

Still, I feel that the market is increasingly populated by runners, resellers, and unofficial dealers who carry the “collector” label proudly — but the reality is quite different. Some of them are indeed collectors who are just supplementing their income. Regardless, they all help deepen the market and improve liquidity for numismatic material.

Lot 329 – 60 Kreuzer 1565, Maximilian II, Joachimsthal

A collector par excellence

No matter what anyone says — including Mr. Kokolus himself — to me, he is above all a collector. And not just any collector, but the uncrowned king of Czechoslovak numismatics. A collector par excellence. His erudition, systematic approach, and ability not only to calculate but also to put in the hard work make him a successful manager and investor.

A Collection That Rewrites History

The sixth part of his collection is again just a small glimpse into his collector’s legacy. When people marvel at the amount, value, and quality of what Mr. Kokolus has released to the market, I always smile and say, “You haven’t seen anything yet.” And I’m not exaggerating. So far, we’ve only been nibbling at the crust. What lies at the heart of his collection — from Rudolph II to Leopold I — deserves its own museum.

Collector Jaroslav Kokolus

Comparisons Speak for Themselves

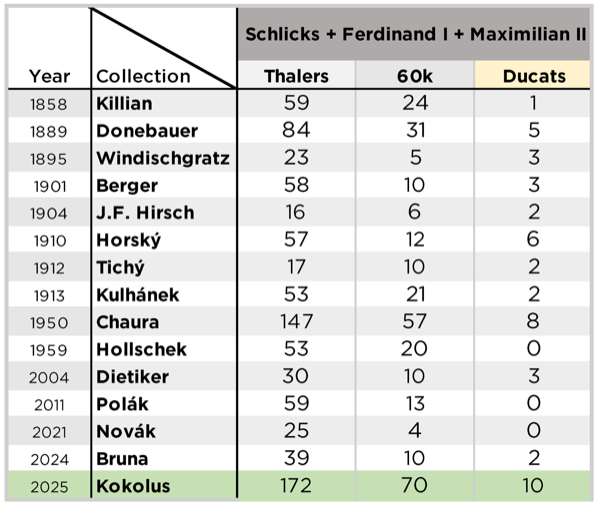

Bohemian treasures — Schlicks, Ferdinand I, and Maximilian II — are just a subtle part of the entire collection in terms of value. To help you grasp the scale and significance of the Kokolus collection, let me compare it to the largest, most interesting, most cited, and most valuable collections that have emerged in this field since the Industrial Revolution.

Kokolus’s collection clearly dominates across all monitored categories. Only the Chaura collection comes close in several parameters. To match Kokolus’s scale, you would need to combine at least two to four of the most important collections.

There are as few Bohemian ducats of Ferdinand I and Maximilian II as saffron. Mr. Kokolus owns 10 pieces. To give perspective: the median of all other major collections is just two pieces.

He collected 242 pieces of heavy silver coins — thalers and 60 kreuzers. This section forms a clear core of the collection. Apart from Chaura’s collection, which is close in quantity, the average number of heavy silver coins in other top collections is 57 pieces — almost five times fewer.

My goal has been to express, even in plain numbers, the uniqueness of the collection we are bringing to the market together with Jaroslav Kokolus. Believe me: it’s almost certain none of us will see anything like this gathered in one auction again in our lifetime.

We look forward to sharing this extraordinary experience with you.

Ing. Elizej Macho Jr.